Financial technology, or fintech, has been revolutionizing the way we interact with money and banking services. One area where these innovations are making a significant impact is in improving financial inclusion for people with disabilities. Companies like Dock and Parabank have been at the forefront of this movement, working tirelessly to create solutions that cater to the unique needs of this often-overlooked demographic.

Understanding the Challenge

Individuals with disabilities face numerous barriers when it comes to accessing traditional financial services. From physical limitations that make it difficult to visit brick-and-mortar banks to a lack of accommodations for visual or hearing impairments, navigating the financial system can be a daunting task for many. This exclusion not only hinders their ability to manage their finances effectively but also perpetuates inequality by denying them opportunities for economic empowerment.

The Role of Fintech

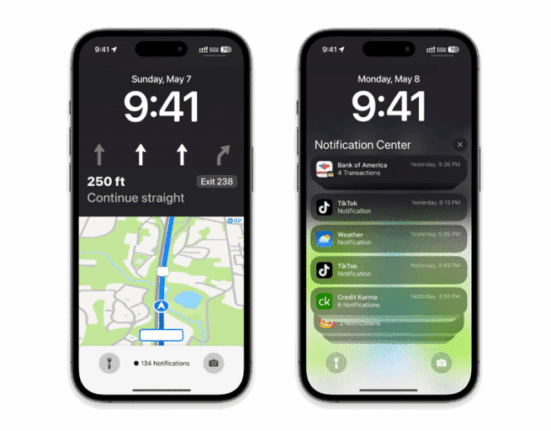

Dock and Parabank are two companies that have recognized these challenges and are actively working towards creating a more inclusive financial landscape. By leveraging cutting-edge technology, they have developed platforms and services specifically designed to meet the needs of individuals with disabilities. Whether it’s through accessible mobile banking apps, voice-activated features, or customizable interfaces, these companies are breaking down barriers and empowering people to take control of their financial futures.

Expert Insights

According to industry experts, the impact of fintech on disability inclusion goes beyond just providing access to basic banking services. By incorporating features such as real-time transaction alerts, budgeting tools tailored for different needs, and even AI-powered financial advisors, fintech companies are not only making finance more accessible but also more personalized and user-friendly.

A Personal Story

Take Sarah, for example – a young woman living with a visual impairment who struggled for years to independently manage her finances. Traditional banks offered little in terms of support, leaving her feeling frustrated and dependent on others for simple tasks like checking her account balance or transferring money. However, when she discovered Dock’s innovative mobile app with its voice recognition capabilities and screen reader compatibility, everything changed. Suddenly, Sarah could confidently handle her finances without assistance, giving her a newfound sense of freedom and autonomy.

Looking Ahead

As Dock ad Parabank continue to refine their offerings and expand their reach, the future looks promising for individuals with disabilities seeking greater financial independence. With ongoing advancements in artificial intelligence, biometric security measures, and user experience design, fintech holds immense potential to level the playing field and ensure that everyone has equal access to essential financial services.

In conclusion,

The combined efforts of companies like Dock ad Parabank are not only transforming the way we think about finance but also reshaping our understanding of inclusivity in an increasingly digital world. By putting accessibility at the forefront of their innovation agenda,

they are paving the way for a future where disability is no longer a barrier to financial well-being.

Leave feedback about this