Uncertainty looms over Australia’s economic horizon as the repercussions of President Donald Trump’s tariffs start to ripple through global markets. According to a Reserve Bank official, the indirect effects of these tariffs are expected to cast a shadow on the Australian economy, leading to weaker growth prospects and lower inflation rates.

Assistant Governor Sarah Hunter highlighted that while direct negative impacts may not be imminent for Australia, the overall uncertainty in the global economy is likely to take its toll. The evolving nature of Trump’s tariff policies has made it increasingly challenging to predict how these changes will shape the future landscape of the economy.

In a recent speech at the Economic Society of Australia Queensland, Hunter emphasized that heightened uncertainty could significantly impact domestic activity if it continues unabated. The Reserve Bank’s decision to cut interest rates was influenced by concerns stemming from this prevailing uncertainty in the global economic environment.

“Global uncertainty may weigh substantially on domestic activity if uncertainty remains elevated,”

Hunter cautioned, pointing out that businesses tend to delay crucial decisions like investments in times of heightened uncertainty. This cautious approach can have a cascading effect on investment, output, and employment levels.

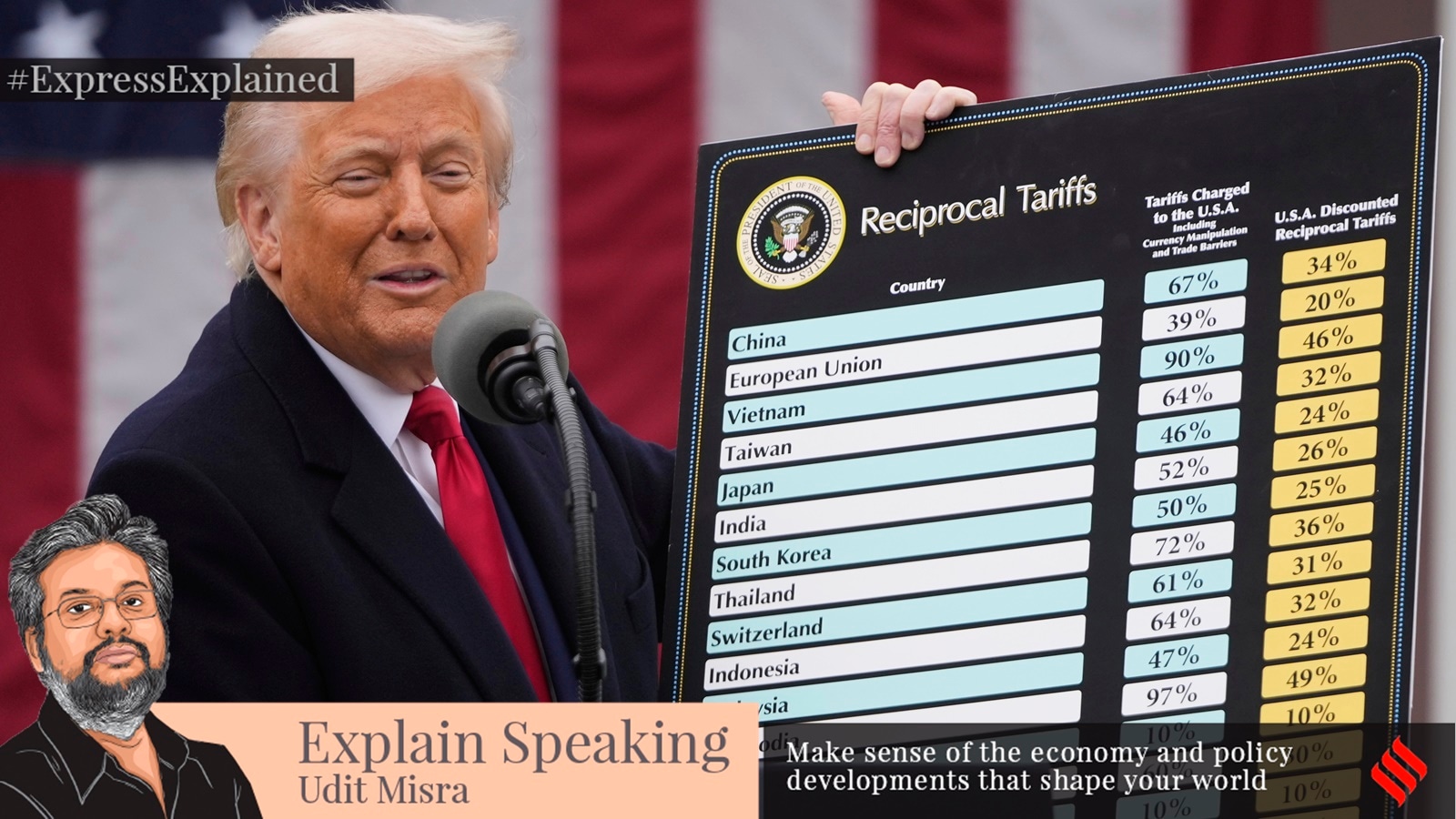

The unpredictability surrounding Trump’s trade policies has triggered spikes in various indices measuring economic uncertainty. For instance, both the Economic Policy Uncertainty Index (EPU) and Volatility Index (VIX) experienced sharp increases post-Trump’s tariff announcements. Such uncertainties can lead to adverse effects on investment decisions by businesses and even influence household consumption patterns.

Hunter stressed that while current forecasts anticipate a modest drag on Australia’s economy due to global uncertainties, any escalation into a full-blown trade war could result in a substantial pullback in economic activity within the country. The RBA remains vigilant about monitoring key transmission channels through which US tariffs could impact Australia across different sectors like trade flows, consumer behavior shifts, and financial market responses.

As uncertainties continue to unfold globally with ongoing policy shifts and retaliations among major trading partners, forecasting economic trends becomes an increasingly intricate task. The structural changes induced by Trump’s tariffs have far-reaching implications that could potentially reshape the world economy.

In conclusion, amid this volatile climate of unpredictable policy actions and escalating tensions, Australia braces itself for an uncertain future marked by challenges such as slower economic growth projections and slightly weakened labor market conditions. As experts navigate through these uncharted waters of economic globalization impacted by external forces like Trump’s tariffs, adaptability and strategic foresight remain paramount for safeguarding national interests across diverse sectors.

Leave feedback about this